Bitget UEX Daily Report | Trump's tariff threat escalates, U.S. stocks plummet; gold and silver prices hit all-time highs; Federal Reserve chair nominee to be finalized soon (January 21, 2026)

Jan 21, 2026 10:48:02

# 1. Hot News

Federal Reserve Dynamics

Trump accelerates the selection of Federal Reserve successor, Powell attends Supreme Court hearing

Federal Reserve Chairman Powell will attend the Supreme Court hearing on the case of Governor Lisa Cook today, which concerns the independence of the Federal Reserve. - Treasury Secretary Mnuchin revealed that Trump has narrowed down the candidates to four, with an announcement expected as early as next week, including Kevin Hassett and Kevin Warsh among the candidates; - A UBS report warns that if the court ruling is unfavorable, it may open the door for the White House to bypass legal avenues to dismiss Federal Reserve officials.

Market Impact: This move increases uncertainty regarding Federal Reserve policy, which may further weaken confidence in the dollar and drive up demand for safe-haven assets.

International Commodities

Geopolitical trade tensions escalate, gold and silver continue to hit record highs

Trump's tariff threats have triggered heightened risk aversion, causing spot gold and silver prices to soar to new records. - Gold rose over 2% at one point, reaching $4,766 per ounce; - Silver increased by over 1%, peaking at $95.9 per ounce; - Bridgewater's Dalio warned of the risks of a "capital war," viewing gold as a key hedging tool.

Market Impact: Concerns over the trade war combined with a weakening dollar enhance the appeal of precious metals as safe-haven assets, potentially supporting short-term price increases, but caution is needed regarding the impact of a global economic slowdown on demand.

Macroeconomic Policy

Trump's tariffs pressure the EU, optimistic but cautious outlook for US economic growth

Trump reiterated that if tariffs are limited, he will use alternative measures such as licensing against the EU and does not rule out the use of force to seize Greenland. - The European Parliament has frozen the approval of the US-EU trade agreement in response to Trump's 10% tariff threat; - US Commerce Secretary Ross predicts first-quarter GDP growth exceeding 5%, potentially reaching 6% if interest rates are cut, but warns the EU against retaliation; - ADP data shows weekly job additions slowing to 8,000, indicating a decline in hiring pace.

Market Impact: Escalating tariffs may reignite the global trade war, dragging down the stock market and amplifying economic uncertainty, but expectations of interest rate cuts may cushion some negative impacts.

# 2. Market Review

- Spot Gold: Up 1.31% +; hitting record highs, driven by risk aversion;

- Spot Silver: Slightly down 0.55% +; fluctuating at high levels, supported by safe-haven & industrial demand;

- WIT Crude Oil: Slightly down 0.91%; Chinese economic growth boosts demand, but trade tensions limit gains;

- Dollar Index: Slightly down 0.04%; tariff threats trigger outflows of safe-haven funds;

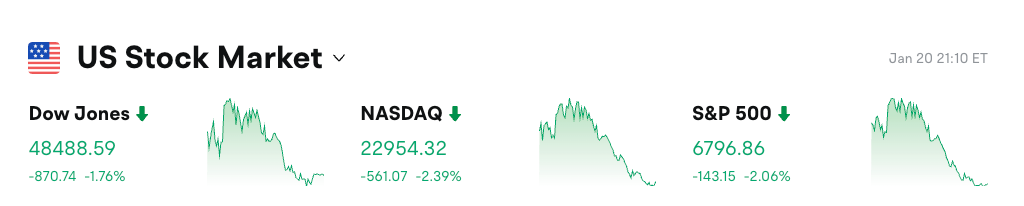

US Stock Index Performance

- Dow Jones: Down 1.76% +, marking the largest single-day drop in nearly three months, dominated by trade concerns

- S&P 500: Down 2.06% +, the worst performance since October last year, dragged down by the tech sector

- Nasdaq: Down 2.39% +, tech stocks broadly sold off, exacerbated by geopolitical risks

Tech Giants Dynamics

- NVIDIA: Down 4.38%, trade war escalates concerns over chip demand

- Tesla: Down 4.17%, concerns over supply chain disruptions intensify

- Apple: Down 3.46%, rising risks in the European market

- Amazon: Down 3.40%, global trade tensions impact e-commerce logistics

- Google: Down 2.42%, advertising business impacted by economic uncertainty

- Meta: Down 2.60%, expectations of slowing user growth increase

- Microsoft: Down 1.16%, fluctuations in cloud service demand Overall, the seven tech giants fell mainly due to Trump's tariff threats triggering panic over a global trade war, with the tech sector being particularly sensitive and under significant short-term pressure.

Sector Movement Observation

Precious Metals Sector rose about 6%

- Representative stocks: Kinross Gold, up 8.62%

- Driving factors: Geopolitical tensions and a weak dollar boost safe-haven demand, with gold and silver hitting new highs driving mining stocks' activity

Cryptocurrency Sector fell about 7%

- Representative stocks: Coinbase, down 5.57%

- Driving factors: Bitcoin fell below $90,000, Ethereum lost the $3,000 mark, with a wave of risk asset sell-offs affecting the sector

# 3. In-Depth Stock Analysis

1. Netflix - Q4 performance exceeds expectations but outlook is weak

Event Overview: Netflix's Q4 revenue reached $12.05 billion, exceeding the estimated $11.97 billion; earnings per share were $0.56, up from $0.43 in the same period last year; free cash flow was $1.87 billion, surpassing the expected $1.46 billion. However, the company expects 2026 revenue to be between $50.7 billion and $51.7 billion, slightly below the estimated $50.96 billion; Q1 operating profit is projected at $3.91 billion, with earnings per share of $0.76, both below market expectations. After-hours stock price fell over 5% at one point. Additionally, Netflix revised its $72 billion acquisition plan for Warner Bros. Discovery from a cash-and-stock deal to an all-cash deal to expedite shareholder voting.

Market Interpretation: Goldman Sachs analysts believe the results show strong subscription growth, but the expansion of the advertising business is slow; Morgan Stanley points out that the weak outlook reflects intensified competition and rising content costs.

Investment Insight: Short-term stock prices may be pressured by the lowered guidance, while long-term attention should be paid to streaming media merger and acquisition opportunities.

2. NVIDIA - Trade tensions heighten chip demand concerns

Event Overview: NVIDIA's stock price fell 4.38%, affected by Trump's tariff threats, leading to a broad decline in the semiconductor sector. The company has no major announcements recently, but as a leader in AI chips, its supply chain is highly dependent on global trade stability. Market concerns about potential EU retaliation measures could disrupt European market expansion and indirectly affect the Asian supply chain.

Market Interpretation: Bernstein analysts warn that escalating trade wars will raise chip costs; UBS believes there will be significant short-term volatility, but AI demand remains strong in the long term.

Investment Insight: In the current risk-averse environment, it is advisable to wait and see, considering low-position layouts after geopolitical risks ease.

3. Tesla - Rising risks of supply chain disruptions

Event Overview: Tesla's stock price fell 4.17%, continuing the tech stock sell-off. The company has no new events, but with a high proportion of sales in the European market, Trump's tariff threats against the EU directly impact its exports and parts procurement. Recently, Model Y sales have been strong, but global trade uncertainty is amplifying.

Market Interpretation: Citi analysts point out that tariffs may raise prices in Europe, affecting demand; Barclays believes that speeding up Cybertruck production could partially offset this.

Investment Insight: Short-term volatility is increasing; attention should be paid to policy support for new energy as a buffer.

4. Alibaba - Chinese concept stocks broadly decline due to US stock market drag

Event Overview: Alibaba fell 1.82%, with the Nasdaq Golden Dragon China Index overall declining 1.45%. Although there are no specific company news, the sharp decline in US stocks and trade war concerns have impacted Chinese concept stocks. Alibaba's e-commerce business remains robust, but it is highly sensitive to cross-border trade.

Market Interpretation: JPMorgan analysts believe that geopolitical tensions will suppress valuations in the short term; Goldman Sachs is optimistic about its cloud business growth potential.

Investment Insight: It is advisable to increase holdings when US-China relations stabilize, while currently controlling positions.

# 4. Today's Market Calendar

Data Release Schedule

Important Event Forecast

- Trump's Davos Speech: Wednesday - Focus on Greenland negotiations and tariff policy statements

- Powell attends Supreme Court hearing: Wednesday - Focus on the debate over Federal Reserve independence

- Davos Forum high-level meetings: All day - Progress on US-EU trade agreement

Bitget Research Institute's View:

US stocks are severely impacted by Trump's tariff threats, with the S&P 500 recording the largest drop in three months, led by the tech sector; precious metals are strong, with gold and silver hitting records driven by safe-haven demand and a weak dollar, with Bridgewater's Dalio viewing gold as the preferred hedge against a "capital war"; crude oil benefits from growth in China, but trade war risks limit gains; balanced allocation is recommended.

Disclaimer: The above content is compiled by AI search, with human verification for publication, and should not be considered as any investment advice.

Related Projects

Latest News

ChainCatcher

Jan 21, 2026 16:44:28

ChainCatcher

Jan 21, 2026 16:38:52

ChainCatcher

Jan 21, 2026 16:31:03

ChainCatcher

Jan 21, 2026 16:30:16

ChainCatcher

Jan 21, 2026 16:29:33