"The lucky big spender" hunts for quantitative robots

Jan 22, 2026 09:24:36

In today's stock market, where quantitative trading is all the rage, most people believe that these cold algorithmic robots are the ruthless harvesters of Wall Street, continuously extracting the hard-earned money of retail investors who fall victim to emotional misjudgments or information asymmetry at lightning speed.

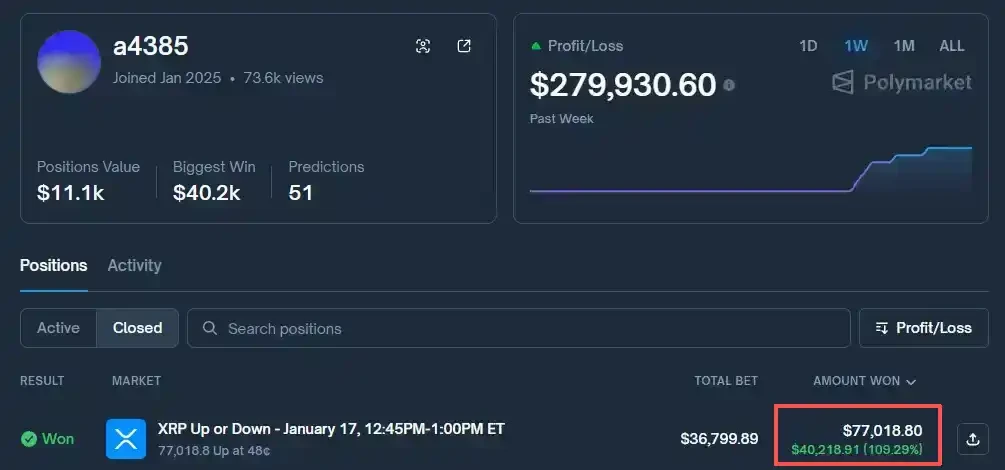

However, in an emerging market over the past 48 hours, several top quantitative robots experienced nearly perfect profit curves that collectively collapsed, while a mysterious account named a4385 managed to rake in $280,000 from it.

This market is called the prediction market, where a trader named a4385 showcased a meticulously planned hunt targeting quantitative robots to the world.

Financial Version of "Guess the Size": An Arbitrage Paradise for Quantitative Models

Everyone understands the game of guessing sizes, and there are similar plays in the prediction market.

For example, if you bet on "Will the gold price go up or down tomorrow?" and you bet on "up," and the price indeed goes up tomorrow, then regardless of how much it rises, your "up" position will be settled for profit based on the odds at the time of betting, while the odds correspond to the probability of the event occurring. Conversely, if the price falls, no matter how much it drops, your position will go to zero.

"Will XRP go up or down in 15 minutes?" is a typical representative of many markets in the prediction market. Each 15-minute market opens with a starting price; after 15 minutes, if the price of XRP is higher than the starting price, traders who bet on "up" profit, while those who bet on "down" profit if the price is lower.

As shown, Price To Beat corresponds to the starting price, and Current Price corresponds to the real-time price. The red "12:29" in the upper right corner corresponds to the remaining time until settlement. If the price line is above the "target" in the image at settlement, those who bet on "up" profit; otherwise, those who bet on "down" profit.

This real-time mechanism makes this market a paradise for quantitative robots: algorithms capture pricing deviations caused by retail investors due to emotions, information delays, remaining time, and other reasons through sophisticated statistical models, and perfectly eat away at stable profits through automated trading.

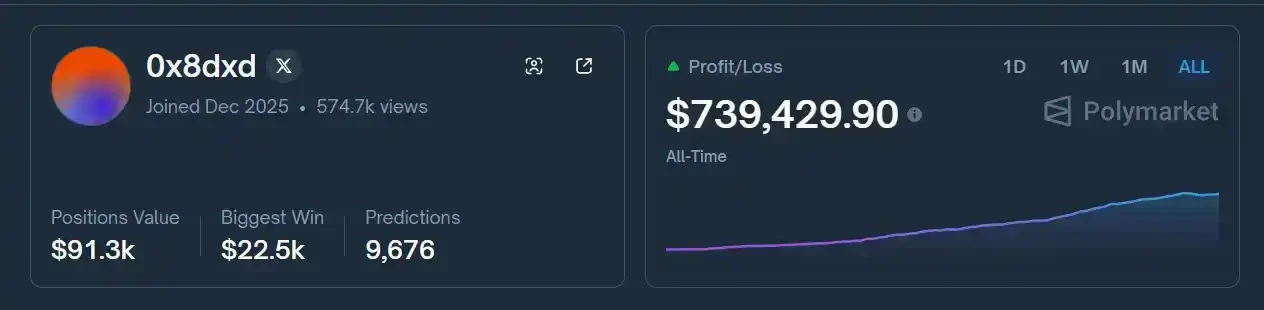

0x8dxd is a perfect example among many quantitative robots: since its launch on December 5, 2025, it has accumulated profits of $740,000 over the past 44 days, participating in an average of 219 different markets daily, with a very smooth profit curve.

XRP Soars Right at Settlement, "Lucky Big Player" Doubles Funds

On the afternoon of January 17, 2026, a4385 bet on "up" in the "Will XRP go up or down in 15 minutes?" market.

The starting price for XRP in this market was $2.0784, and until 17:58:54 (66 seconds remaining until settlement), XRP's price was still hovering at $2.0737, with a corresponding probability of only 36% for an increase—market consensus believed that XRP would struggle to rise above the starting price in the remaining minute.

However, in the next minute, XRP suddenly began to rise continuously, and at the time of market settlement, the quote was fixed at $2.0817—just crossing above the starting price.

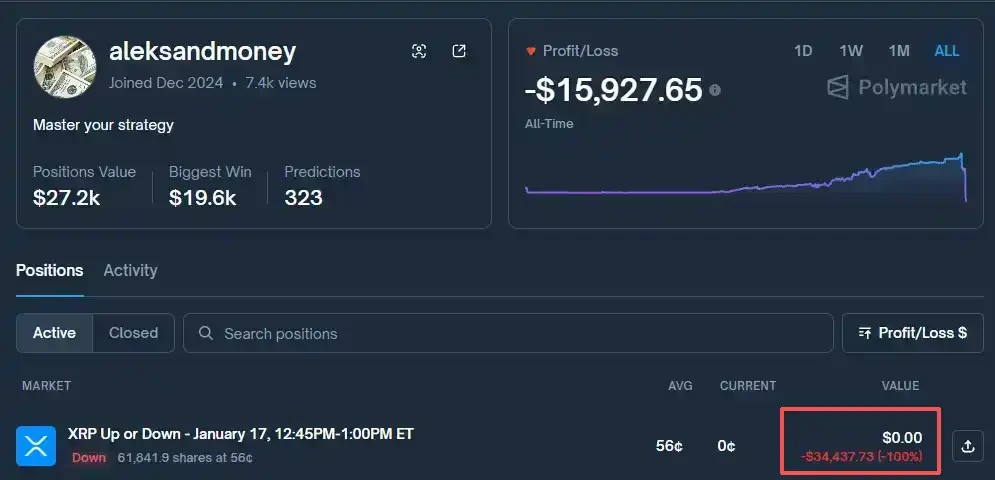

This meant that a4385 achieved substantial profits from entry to settlement, while quantitative robots like the one shown in the image below lost all historical profits due to this single market and even faced additional losses.

This quantitative robot had made over $40,000 in profits over the past seven months, but it lost $34,000 in this market.

The Careful Manipulation Behind Repeated Good Fortune

After the market settled, people found that a4385 replicated several similar "lucky" operations: just one minute before settlement in multiple markets, XRP's price suddenly surged, only to quickly drop back the second after settlement.

This led people to suspect that his "luck" might not be a coincidence, but rather a precise strike against quantitative robots.

Theoretically, a4385 could first bet on "up" when XRP's real-time price was below the starting price, and then in the last minute before settlement, buy XRP in large market orders to artificially push up the price, ensuring that the settlement price was above the starting price, thus locking in profits.

At this point, all previously seemingly insignificant details began to matter: the 17th was a weekend, meaning that the order book depth provided by market makers for XRP was insufficient to buffer large trades in a short time.

Choosing XRP, a less popular asset compared to Bitcoin, further ensured a shallower order book depth, allowing the operator to move the price with less cost in a short time.

This provided a4385 with a perfect brief manipulation window:

First, in the prediction market, a4385 made multiple large bets on "up" within 10 minutes before the market settled. Since the real-time prices during this period were all below the starting price, the odds for betting were relatively high.

On the corresponding XRP price chart, until just before 17:59, the price hovered around 2.074. In the last minute, a surge of unusually large trading volume flooded in, causing the price to suddenly break above the starting price (red horizontal line).

Once the market successfully settled, a4385 immediately sold the XRP it had just bought, causing the price to drop back instantly.

If we assume that all market buy orders at 17:59 came from a4385, then based on the trading volume of $569,000 for that minute, and with an exchange fee of 0.32%, the total cost of buying and selling would be approximately $6,200.

Meanwhile, his profit from betting "up" in this market was $40,218. By continuously replicating this strategy, he had already earned nearly $300,000 within 48 hours.

While marveling at a4385's seemingly money-printing operations, we also need to consider the costs behind this seemingly "retail investor counterattack" story.

Buying to push the price up not only incurs thousands of dollars in transaction fees but also results in significant losses due to price drops when selling after settlement.

Therefore, while pushing the price up, he also needed to hold a corresponding 1x short position. Only in this way, regardless of how violently the price of the XRP he held fluctuated, could the total value of his assets remain unchanged.

In other words, in addition to bearing transaction fee losses, he also needed over a million dollars in liquidity to ensure the feasibility of this strategy.

Thus, this is not a game of luck for gamblers, nor a carnival for ordinary retail investors.

Behind each legendary story of casino profits, perhaps those who laugh last are never luck itself, but rather the inevitable result of capital, structure, and rules being precisely calculated.

Latest News

ChainCatcher

1月 23, 2026 09:10:53

ChainCatcher

1月 23, 2026 09:00:11

ChainCatcher

1月 23, 2026 08:49:27

ChainCatcher

1月 23, 2026 08:40:53

ChainCatcher

1月 23, 2026 08:31:19