When Ethereum pays interest to TradFi: Staking hits new highs, exits clear out, is ETH迎来结构拐点?

Jan 21, 2026 23:58:03

Author: imToken

Can holding an Ethereum ETF allow you to receive interest like holding bonds?

At the beginning of the month, Grayscale announced that its Grayscale Ethereum Staking ETF (ETHE) has allocated earnings obtained through staking to existing shareholders for the period from October 6, 2025, to December 31, 2025. This also marks the first distribution of staking rewards to holders of a spot cryptocurrency trading product in the U.S.

While this move may seem ordinary to Web3 native players as a routine on-chain operation, in the context of crypto finance history, it signifies that Ethereum's native yield has been packaged into the standard shell of traditional finance for the first time, undoubtedly a milestone.

What’s even more noteworthy is that this is not an isolated event. On the on-chain data level, Ethereum's staking rate continues to rise, with validators exiting the queue gradually being digested and re-accumulating in the entry queue. A series of changes are happening simultaneously.

These seemingly scattered signals are pointing towards a deeper question: Is Ethereum gradually evolving from an asset primarily characterized by price volatility into a type of "yield-bearing asset" that is accepted by long-term funds and possesses stable income attributes?

1. ETF Earnings Distribution: Traditional Investors' "First Experience" with Staking

Objectively speaking, for a long time, Ethereum staking has felt more like a technical experiment with a bit of a geeky quality, limited to the "on-chain world."

This is because it not only requires users to have basic knowledge of wallets, private keys, and other crypto fundamentals but also to understand the validator mechanism, consensus rules, lock-up periods, and penalty logic. Although liquid staking (LSD) protocols represented by Lido Finance have significantly lowered the entry threshold, staking rewards themselves still primarily remain within the crypto-native context (such as wrapped tokens like stETH).

Ultimately, for most Web2 investors, this system is neither intuitive nor easily accessible, creating an insurmountable gap.

Now, this gap is being bridged by ETFs. According to Grayscale's distribution plan, ETHE holders will receive $0.083178 for each share they hold, reflecting the earnings obtained and sold through staking during the corresponding period. The distribution will occur on January 6, 2026 (the ex-dividend date), for investors holding ETHE shares as of January 5, 2026 (the record date).

In short, this income does not come from business operations but from network security and consensus participation itself. In the past, such earnings existed almost exclusively within the crypto industry, but now they are being packaged into the familiar financial shell of an ETF. Through U.S. stock accounts, traditional 401(k) or mutual fund investors can obtain native earnings generated by Ethereum network consensus (in dollar form) without needing to interact with private keys.

It is important to emphasize that this does not mean that Ethereum staking has achieved full compliance, nor does it represent a unified stance from regulators on ETF staking services. However, economically speaking, a key change has occurred: non-crypto-native users have, for the first time, indirectly obtained native earnings generated by Ethereum network consensus without needing to understand nodes, private keys, or on-chain operations.

From this perspective, the ETF earnings distribution is not an isolated event but the first step for Ethereum staking to enter a broader capital vision.

Grayscale is quickly becoming not an isolated case; the Ethereum ETF under 21Shares has also announced that it will distribute earnings obtained through staking ETH to existing shareholders. The distribution amount is $0.010378 per share, and the relevant ex-dividend and payment processes have been disclosed.

This undoubtedly sets a great precedent, especially for institutions like Grayscale and 21Shares that have influence in both TradFi and Web3. Their demonstration effect goes far beyond a single dividend; it will undoubtedly drive the effective implementation and popularization of Ethereum staking and earnings distribution in the factual realm, marking that Ethereum ETFs are no longer just shadow assets following price fluctuations but are truly financial products capable of generating cash flow.

From a longer-term perspective, as this model is validated, it is not ruled out that traditional asset management giants like BlackRock and Fidelity will follow suit, potentially injecting hundreds of billions in long-term allocation funds into Ethereum.

2. Record High Staking Rates and Disappearing "Exit Queue"

If the ETF earnings are more of a narrative breakthrough, then the changes in the total staking rate and staking queue more directly reflect the behavior of funds themselves.

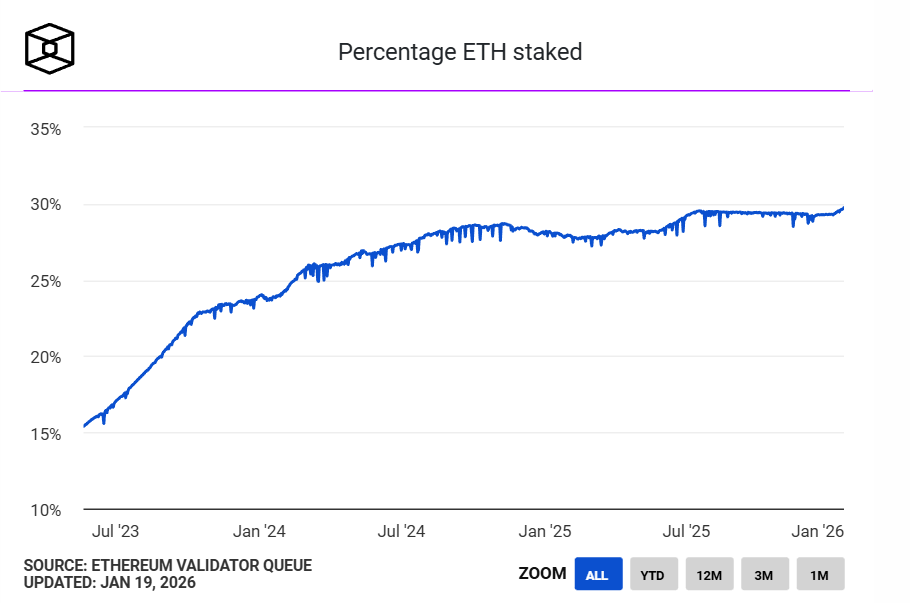

First, Ethereum's staking rate has reached an all-time high. According to statistics from The Block, over 36 million ETH are currently staked on the Ethereum Beacon Chain, accounting for nearly 30% of the network's circulating supply, with a staking market value exceeding $118 billion, setting a new historical record. The previous highest record for the circulating supply ratio was 29.54%, which occurred in July 2025.

Source: The Block

From a supply-demand perspective, a large amount of ETH being staked means that it has temporarily exited the freely circulating market, indicating that a significant portion of circulating ETH is transitioning from a high-frequency trading asset to a long-term allocation asset that assumes functional roles.

In other words, ETH is no longer just a gas, trading medium, or speculative tool; it is beginning to assume the role of "means of production"—it participates in network operations through staking and continuously generates returns.

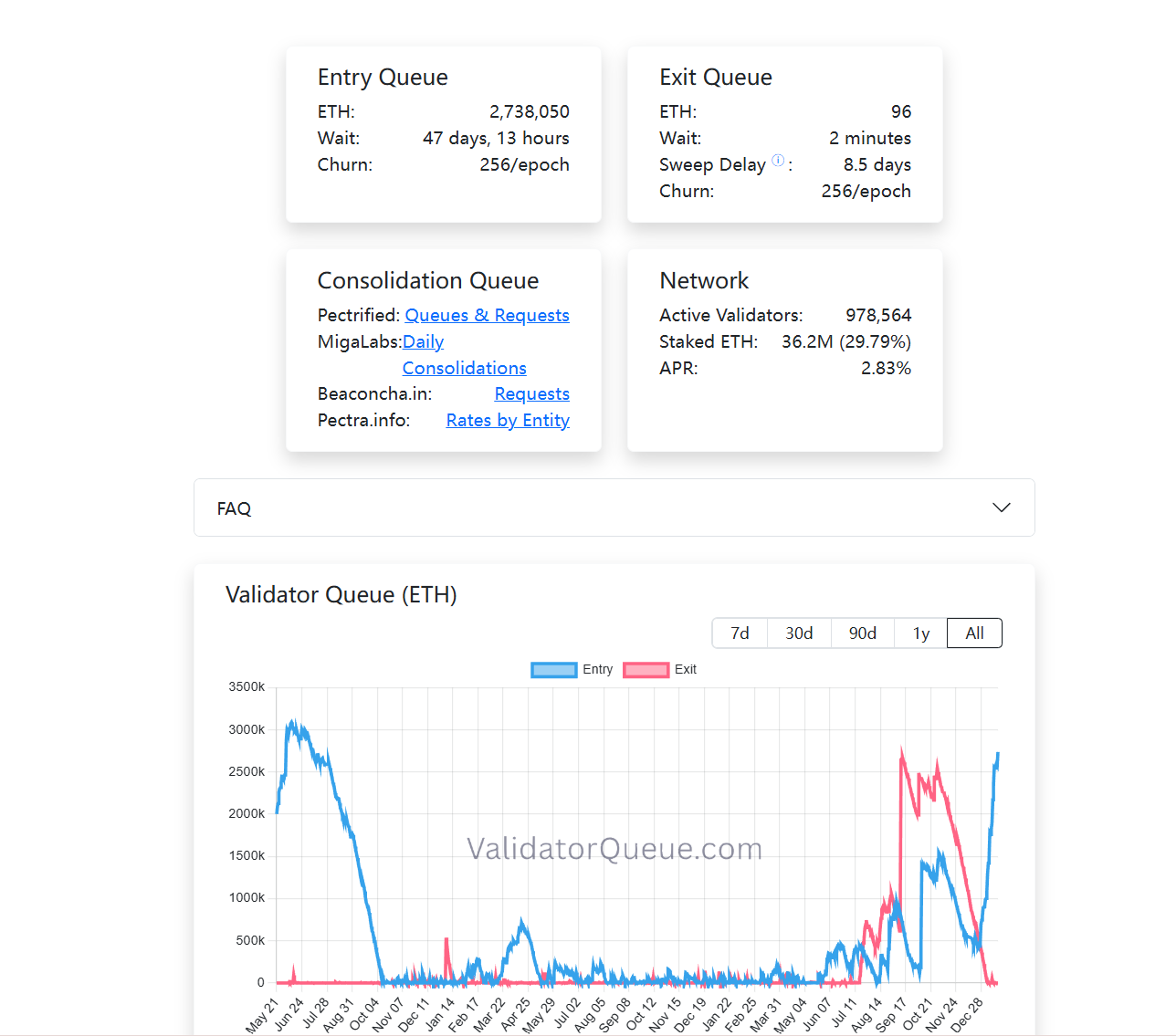

At the same time, the validator queue has also undergone intriguing changes. As of the time of writing, the Ethereum PoS staking exit queue is nearly empty, while the entry queue for staking continues to grow (over 2.73 million ETH). In short, a large amount of ETH is currently choosing to be long-term locked into this system (see further reading: “Penetrating the Noise of Ethereum 'Degeneration': Why is the 'Ethereum Value System' the Widest Moat?”).

Unlike trading behavior, staking itself is a low-liquidity, long-cycle, and stability-focused allocation method. The willingness of funds to re-enter the staking queue at least indicates one thing: at this current stage, an increasing number of participants are willing to accept the opportunity cost for such long-term locking.

When looking at the institutional ETF earnings distribution, record high staking rates, and changes in queue structure together, a relatively clear trend emerges: Ethereum staking is evolving from early on-chain participant dividends into a structurally yield-bearing layer that is gradually accepted by the traditional financial system and reassessed by long-term funds.

Examining any one of these alone is insufficient to form a trend judgment, but together, they are outlining the gradual maturation of the Ethereum staking economy.

3. The Future of an Accelerating Maturation of the Staking Market

However, this does not mean that staking has turned ETH into a "risk-free asset." On the contrary, as the participant structure changes, the types of risks faced by staking are shifting. Technical risks are gradually being digested, while structural risks, liquidity risks, and the cost of understanding mechanisms are becoming more important.

As is well known, during the last regulatory cycle, the U.S. Securities and Exchange Commission (SEC) frequently wielded its regulatory power, taking enforcement actions against several liquid staking-related projects, including unregistered securities charges against MetaMask/Consensys, Lido/stETH, and Rocket Pool/rETH. This has brought uncertainty to the long-term development of Ethereum ETFs.

From a practical perspective, whether and how ETFs participate in staking is essentially more of a product process and compliance structure design issue rather than a denial of the Ethereum network itself. As more institutions explore boundaries in practice, the market is voting with real funds.

For example, BitMine has staked over 1 million ETH in Ethereum PoS, reaching 1.032 million ETH, valued at approximately $3.215 billion, which accounts for a quarter of its total ETH holdings (4.143 million ETH).

In summary, Ethereum staking has come to a point where it is no longer a niche game for the geek circle.

As ETFs begin to stably distribute earnings, as long-term funds are willing to queue for 45 days to enter the consensus layer, and as 30% of ETH transforms into a safety barrier, we are witnessing Ethereum officially constructing a native yield system accepted by the global capital market.

Understanding this change itself may be just as important as whether to participate.

Recommended Reading:

RootData 2025 Web3 Industry Annual Report

The Power Shift of Binance: The Dilemma of a 300 Million User Empire

Related Projects

Latest News

ChainCatcher

Jan 23, 2026 08:40:53

ChainCatcher

Jan 23, 2026 08:31:19

ChainCatcher

Jan 23, 2026 08:26:52

ChainCatcher

Jan 23, 2026 08:23:01

ChainCatcher

Jan 23, 2026 08:18:23