Bitget UEX Daily Report | The U.S. imposes tariffs on eight European countries, causing a rebound; gold and silver hit new highs; U.S. PCE data to be released (January 19, 2026)

Jan 19, 2026 11:13:48

Author: Bitget

I. Hot News

Federal Reserve Dynamics

The Federal Reserve favors inflation indicators about to be released

The market is closely watching this week's Personal Consumption Expenditures (PCE) price index data as a core reference for the Federal Reserve's assessment of inflation.

Third-quarter GDP data is expected to confirm a 4.3% growth in the U.S. economy, but mixed signals from the job market may affect the interest rate path.

Analysis shows that this data may exacerbate fluctuations in expectations for the Federal Reserve to cut rates in 2026, potentially boosting demand for safe-haven assets.

International Commodities

Gold and silver hit historical highs simultaneously

Affected by geopolitical tensions and dollar fluctuations, gold closed at $4667.55 per ounce, up 1.58%; silver closed at $93.74 per ounce, up 4.23%.

Analysts point out that persistent risk aversion is driving precious metals higher, with silver prices expected to soar further in 2026.

This dynamic may stimulate volatility in the commodity market, and investors should be wary of short-term pullback risks.

Macroeconomic Policy

Trump announces tariffs on eight European countries

Due to the Greenland issue, the U.S. will impose a 10% tariff on exports to Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland starting February 1, increasing to 25% on June 1.

The joint statement from the eight countries states that this move undermines transatlantic relations and may trigger a vicious cycle.

The policy may exacerbate global trade tensions, affect stock markets, and raise inflation expectations.

II. Market Review

Spot Gold: +1.39%, rising for several consecutive weeks, supported by safe-haven demand.

Spot Silver: +3.30%, breaking through the $90 mark, with panic buying flooding the market.

WTI Crude Oil: +0.03%, pressured by ample supply and uncertain demand.

U.S. Dollar Index: -0.16%, facing resistance after a three-week rebound, intertwined with geopolitical risks and interest rate expectations.

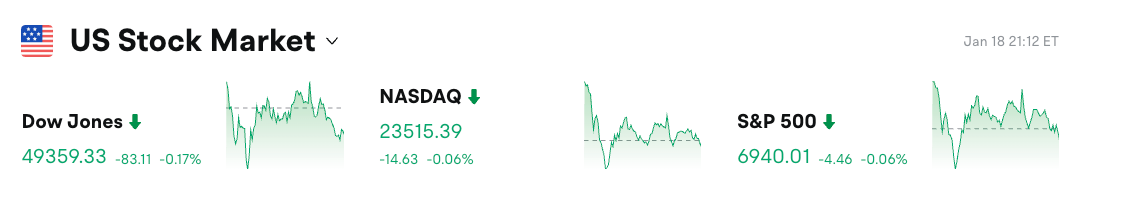

U.S. Stock Index Performance

Dow Jones: -0.17%, experiencing slight adjustments due to financial stocks dragging down performance.

S&P 500: -0.06%, with divergence in technology and industrial sectors.

Nasdaq: -0.06%, driven by fluctuations in AI-related stocks.

Tech Giants Dynamics

Apple: -6% (month-to-date), as investors shift towards value stocks, with concerns over AI fatigue intensifying.

Microsoft: -5% (month-to-date), despite strong earnings, overall tech weakness impacts performance.

Alphabet (Google): +0.5% (YTD), potential SpaceX IPO is favorable for its investments.

Amazon: +10% (expected), analysts are optimistic about e-commerce and cloud growth.

Nvidia: +2% (week-to-date), strong demand for AI chips is expected to lead the market.

Tesla: -2% (week-to-date), adjustments to the FSD subscription model raise valuation concerns.

Meta: -6% (month-to-date), facing regulatory pressure in its advertising business.

Overall, there is a clear divergence among tech giants, primarily due to high valuations and sector rotation, with AI beneficiaries like Nvidia showing relative resilience.

Sector Movement Observation

Basic Materials Sector +11.20% (YTD)

Representative stock: Western Digital (WDC), +368.83% (one year).

Driving factors: Strong performance in metal mining and a rebound in small-cap profitability, benefiting from a low-interest-rate environment.

Industrial Sector +9.26% (YTD)

Representative stock: Micron Technology (MU), +251.64% (one year).

Driving factors: Stimulus expectations and a rebound in manufacturing, with geopolitical risks boosting defensive demand.

Energy Sector +6.07% (YTD)

Representative stock: Seagate Technology (STX), +251.31% (one year).

Driving factors: Supply tightening amid oil price fluctuations, with geopolitical events amplifying uncertainty.

III. In-Depth Stock Analysis

- Nvidia - Explosion in AI Chip Demand

Event Overview: Nvidia's stock rose 2% during the week, benefiting from strong demand for data center accelerators. The company expects AI infrastructure development to continue until 2030, with data center revenues reaching a record $430 million. Analysts view it as a market leader in 2026, benefiting from the AI trend. Market Interpretation: Wall Street is unanimously optimistic, with a consensus target price suggesting over 20% upside, emphasizing its dominance in the semiconductor field. Investment Insight: If the AI investment wave continues, Nvidia could drive index growth, but caution is advised regarding valuation bubbles.

- AMD - Strong Growth Across Multiple Business Lines

Event Overview: AMD enters 2026 with strong momentum, driven by both data center and PC businesses, with annual revenue growth exceeding 20%. The company is increasing investments in AI infrastructure, expecting accelerated growth. Market Interpretation: Institutions believe its chip supply position is solid, predicting a doubling of earnings in 2026, outperforming peers. Investment Insight: As an alternative to Nvidia, AMD offers diversified exposure and is suitable for long-term holding.

- Alphabet - Potential Benefits from SpaceX IPO

Event Overview: Alphabet holds shares in SpaceX, which may benefit from its potential IPO in 2026, valued at $1.5 trillion. The company's search and cloud businesses are stable but face doubts over AI fatigue. Market Interpretation: Analysts predict upside potential, viewing SpaceX as a hidden catalyst, but warn of regulatory risks. Investment Insight: If the satellite business unlocks value, it could boost stock prices; geopolitical impacts should be monitored.

- Tesla - Adjustments to FSD Subscription Model

Event Overview: Tesla fell 2% during the week, shifting to a subscription-only model for FSD, raising valuation concerns. Earnings growth expectations for 2026 reach 284%, but short-term volatility is increasing. Market Interpretation: There is significant divergence on Wall Street, with a consensus 10% upside, focusing on advancements in autonomous driving. Investment Insight: High growth potential exists, but regulatory and competitive pressures need to be monitored.

IV. Today's Market Calendar

Data Release Schedule

Important Event Forecast

Trump leads delegation to Davos: Local time - Focus on discussions of geopolitical policies, which may impact trade and stock markets.

Federal Reserve Monetary Policy Meeting: All day - Interest rate decisions may reveal the path for 2026.

Bitget Research Institute's View:

We hold a cautiously optimistic view on market trends within the next 24 hours, as Trump's proposal for a rate cap intensifies volatility in financial stocks; active issuance in the bond market indicates ample liquidity, with U.S. stocks rotating towards small-cap and value stocks; geopolitical risks are boosting precious metals, but oversupply in crude oil may suppress energy rebounds; overall, AI fatigue and stimulus expectations are intertwined, suggesting a defensive asset allocation.

Disclaimer: The above content is compiled by AI search, with human verification for publication, and should not be considered as any investment advice.

Latest News

ChainCatcher

Jan 19, 2026 21:22:37

ChainCatcher

Jan 19, 2026 21:08:00

ChainCatcher

Jan 19, 2026 21:05:02

ChainCatcher

Jan 19, 2026 21:02:54

ChainCatcher

Jan 19, 2026 21:01:06