How do 99% of unprofitable Web3 projects survive?

1月 09, 2026 11:25:39

Original Author: Ryan Yoon, Tiger Research

Original Compilation: Saoirse, Foresight News

99% of Web3 projects have no cash income, yet many companies still invest huge amounts in marketing and events each month. This article will delve into the survival rules of these projects and the truth behind "burning money."

Key Points

- 99% of Web3 projects lack cash flow, relying on tokens and external funding for their expenses rather than product sales.

- Going public too early (token issuance) leads to skyrocketing marketing expenses, weakening the competitiveness of core products.

- The reasonable price-to-earnings (P/E) ratio of the top 1% of projects proves that the remaining projects lack actual value support.

- Early token generation events (TGE) allow founders to realize "exit monetization" regardless of project success or failure, creating a distorted market cycle.

- The "survival" of 99% of projects essentially stems from a system flaw built on investor losses rather than corporate profits.

The Premise of Survival: A Proven Revenue Capability

"The premise of survival is having a proven revenue capability" ------ this is the most critical warning in the current Web3 space. As the market matures, investors no longer blindly chase vague "visions." If a project cannot acquire real users and actual sales, token holders will quickly sell off and exit.

The key issue lies in the "cash turnover period," which is the time a project can operate without profit. Even without sales, fixed costs such as salaries and server fees still need to be paid monthly, and teams without income have almost no legitimate channels to maintain operating funds.

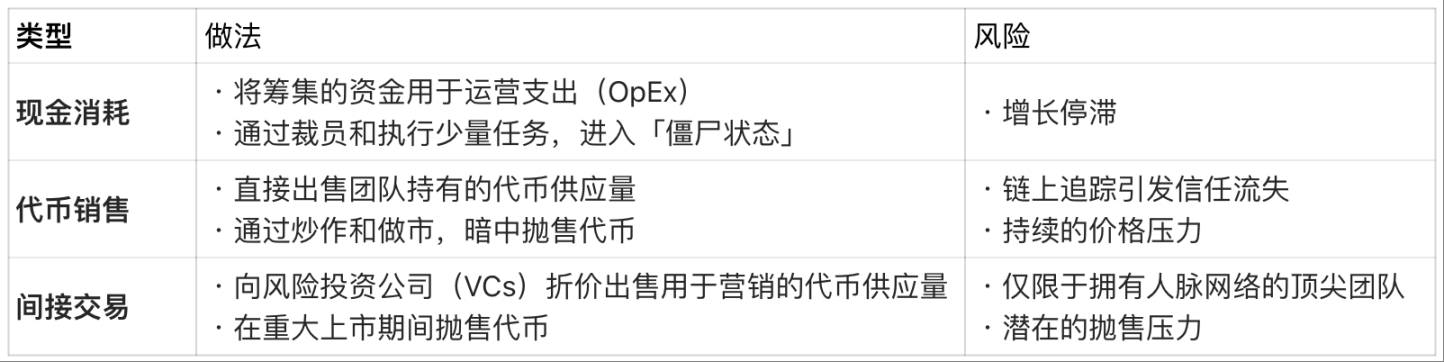

Financing Costs Without Income:

However, this model of "surviving on tokens and external funding" is merely a stopgap. There is a clear upper limit to asset and token supply, and ultimately, projects that exhaust all funding sources will either cease operations or quietly exit the market.

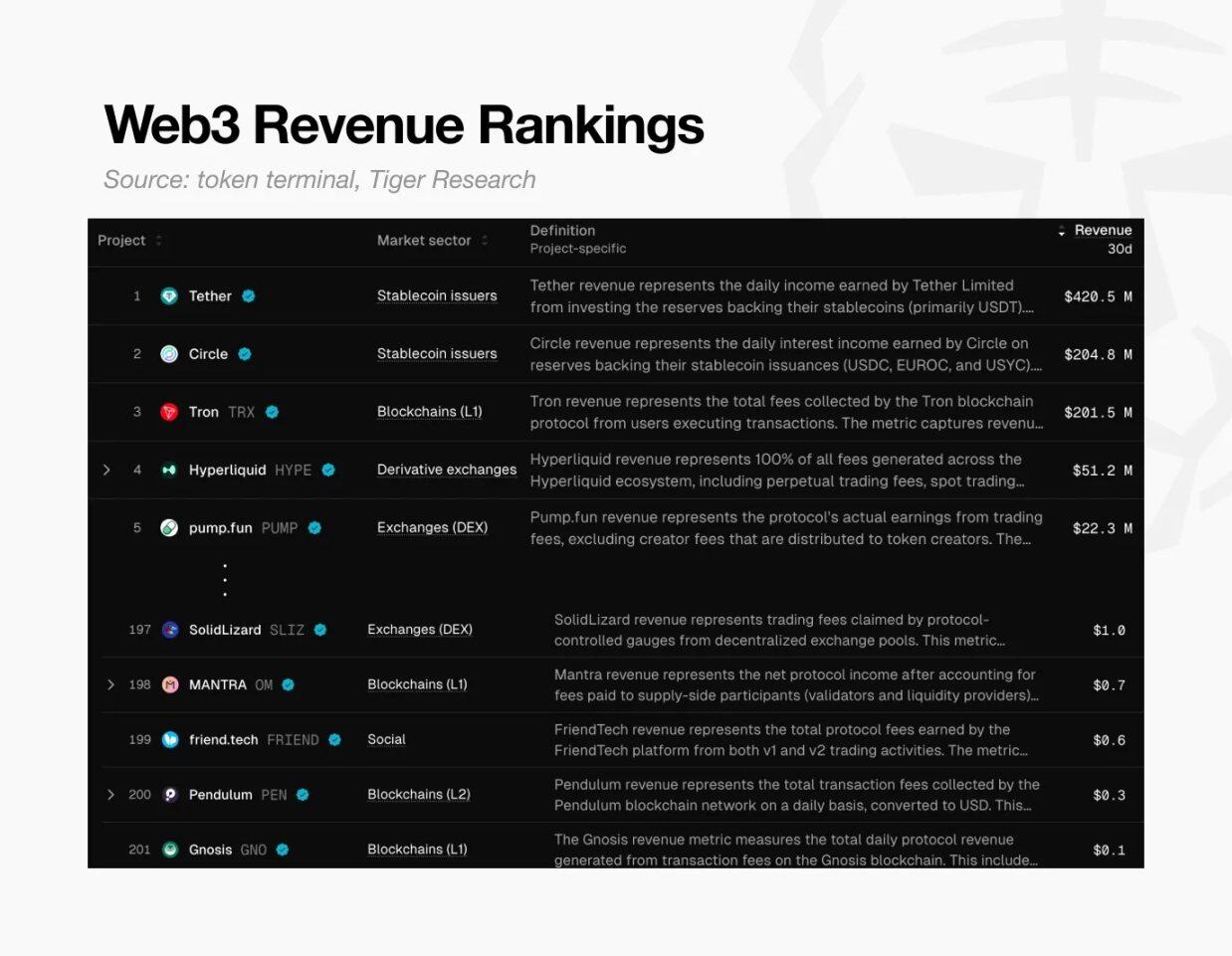

Web3 Revenue Ranking, Source: token terminal and Tiger Research

This crisis is widespread. According to Token Terminal data, globally, there are only about 200 Web3 projects that generated $0.10 in revenue in the past 30 days.

This means that 99% of projects lack even the ability to cover their basic costs. In short, almost all cryptocurrency projects have failed to validate the feasibility of their business models and are gradually heading towards decline.

The Overvaluation Trap

This crisis has largely been predetermined. Most Web3 projects go public (token issuance) based solely on "vision," without even having a real product. This sharply contrasts with traditional businesses, which must prove their growth potential before an initial public offering (IPO); in the Web3 space, teams often have to prove the rationality of their high valuations only after going public (TGE).

But token holders will not wait indefinitely. As new projects emerge daily, if a project fails to meet expectations, holders will quickly sell off and exit. This puts pressure on token prices, threatening project survival. Therefore, most projects invest more funds in short-term speculation rather than long-term product development. Clearly, if the product itself lacks competitiveness, even the most intensive marketing will ultimately fail.

At this point, the project falls into a "dilemma trap":

At this point, the project falls into a "dilemma trap":

- If focused solely on product development: it requires a lot of time, during which market attention gradually fades, and the cash turnover period keeps shortening;

- If focused solely on short-term speculation: the project becomes hollow and lacks actual value support.

Both paths ultimately lead to failure ------ the project cannot prove the rationality of its initial high valuation and eventually collapses.

Seeing the Truth of 99% of Projects Through the Top 1%

However, there are still 1% of leading projects that have proven the feasibility of the Web3 model through substantial revenue.

We can assess their value through the price-to-earnings ratio (PER) of major profitable projects like Hyperliquid and Pump.fun. The P/E ratio is calculated as "market value ÷ annual revenue," and this metric reflects whether a project's valuation is reasonable relative to its actual revenue.

P/E Ratio Comparison: Top Web3 Projects (2025):

Note: Hyperliquid's sales are based on annualized estimates since June 2025.

Data shows that the P/E ratios of profitable projects range from 1x to 17x. Compared to the average P/E ratio of about 31x for the S&P 500 index, these leading Web3 projects are either "undervalued relative to sales" or have "excellent cash flow."

The fact that leading projects with actual earnings can maintain reasonable P/E ratios makes the valuations of the remaining 99% of projects seem untenable ------ it directly proves that the high valuations of most projects in the market lack a foundation of actual value.

Can This Distorted Cycle Be Broken?

Why do projects with no sales still maintain valuations in the billions? For many founders, product quality is a secondary factor ------ the distorted structure of Web3 makes "quick exit monetization" much easier than "building a real business."

The cases of Ryan and Jay illustrate this point perfectly: both launched AAA game projects, but their outcomes were drastically different.

Founder Differences: Comparing Web3 and Traditional Models

Ryan: Chose TGE, Abandoned In-Depth Development

He opted for a path centered on "profit": before the game launched, he raised early funds by selling NFTs; then, while the product was still in rough development, he held a token generation event (TGE) based solely on an aggressive roadmap and completed the listing on a medium exchange.

After going public, he maintained the token price through speculation to buy himself time. Although the game was ultimately delayed and of poor quality, holders sold off en masse. Ryan eventually resigned, claiming "to take responsibility," but he was the true winner of this game ------

On the surface, he pretended to focus on work while actually earning a high salary and making huge profits by selling unlocked tokens. Regardless of the project's ultimate success or failure, he quickly accumulated wealth and exited the market.

In Contrast, Jay: Followed the Traditional Path, Focused on the Product Itself

He prioritized product quality over short-term speculation. However, developing an AAA game takes years, during which his funds gradually ran out, leading to a "cash turnover crisis."

In the traditional model, founders must wait until the product is launched and sales are achieved to reap substantial rewards. Although Jay raised funds through multiple rounds of financing, he ultimately had to shut down the company due to a lack of funds before the game was completed. Unlike Ryan, Jay not only did not make any profits but also incurred significant debt, leaving a record of failure.

Who is the Real Winner?

Neither case produced a successful product, but the winner is clear: Ryan accumulated wealth by exploiting the distorted valuation system of Web3, while Jay lost everything in his attempt to create a quality product.

This is the harsh reality of the current Web3 market: exiting early by leveraging inflated valuations is far easier than establishing a sustainable business model; ultimately, the cost of this "failure" is borne entirely by investors.

Returning to the initial question: "How do 99% of unprofitable Web3 projects survive?"

This harsh reality is the most candid answer to that question.

Latest News

ChainCatcher

1月 10, 2026 23:52:58

ChainCatcher

1月 10, 2026 23:20:48

ChainCatcher

1月 10, 2026 23:17:01

ChainCatcher

1月 10, 2026 22:44:01

ChainCatcher

1月 10, 2026 22:30:27