Understanding Cross-Chain Lending Infrastructure Soul Protocol | CryptoSeed

May 16, 2025 19:07:51

Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

What is Soul Protocol?

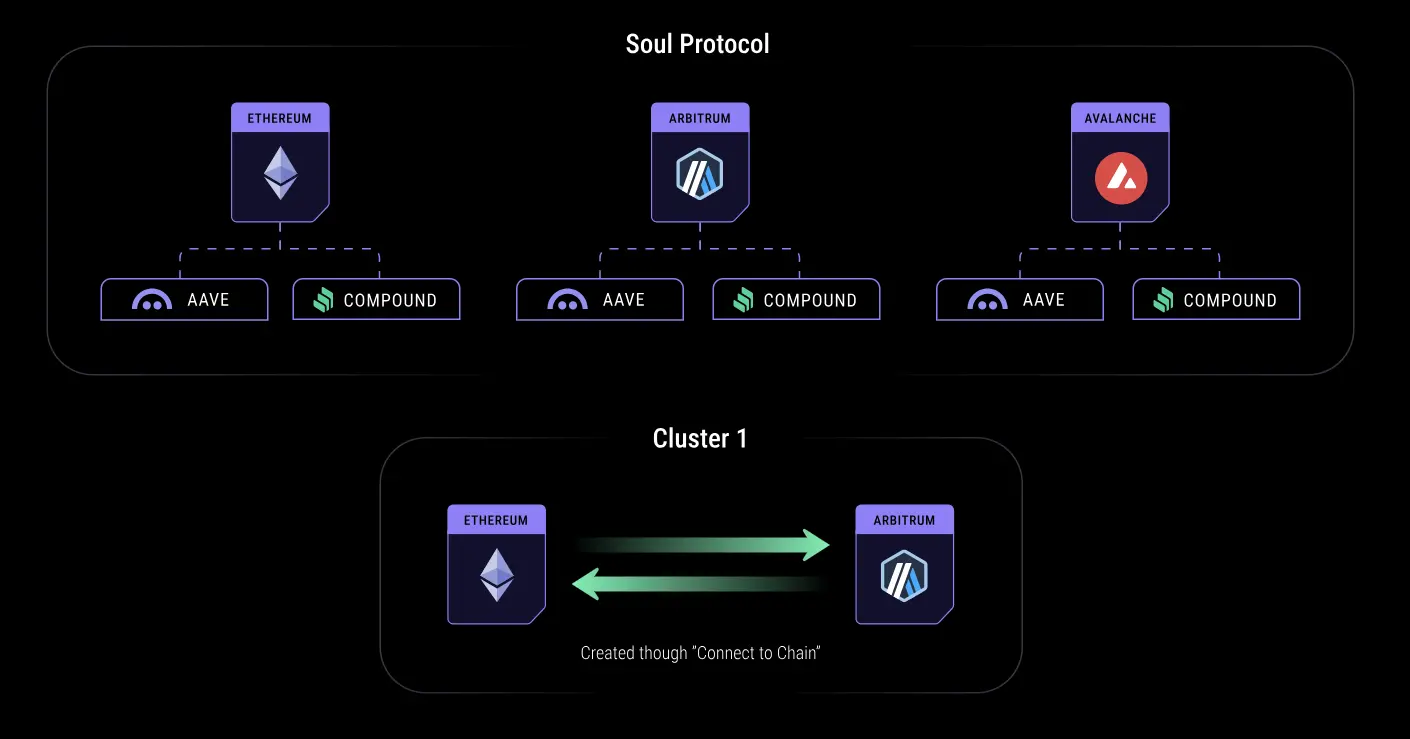

Soul Protocol is a cross-chain lending protocol aimed at bridging the gap between existing DeFi lending protocols and different public chains, helping users to flexibly lend assets across multiple chains and protocols. Users can perform lending operations across chains using mainstream lending protocols like Aave, Compound, and Venus on multiple chains such as Ethereum, Arbitrum, Optimism, and Avalanche.

The characteristic of Soul lies in that it does not rely on asset bridging or issuing synthetic assets, but instead allows users to directly use native assets for lending through cross-chain communication protocols like LayerZero. This design reduces the risks and costs for users when transferring assets between different chains, while enhancing the liquidity and efficiency of the assets.

Currently, Soul is still in the testing phase, open for users to conduct functional testing, feedback, and experience.

How does Soul break the lending barriers?

The current DeFi lending market faces several common issues:

- Decentralized lending protocols

Most existing lending protocols only support a single public chain. If users want to lend between protocols on different chains, they often need to manually switch chains and bridge assets, which is cumbersome.

- High costs and slow speeds for cross-chain lending

Traditional cross-chain lending usually requires bridging assets, which not only adds extra steps but also brings costs and risks regarding asset security. The bridging process itself is also not efficient enough to meet arbitrage or flexible lending needs.

- Limited lending capabilities

Due to assets and lending capabilities being scattered across different chains and protocols, users often cannot consolidate all their assets for lending, leading to reduced capital utilization efficiency.

Soul Protocol aims to solve these issues through a unified cross-chain lending infrastructure:

- Users can deposit assets on any supported chain and lend on other chains or protocols without the need to bridge assets.

- It can automatically match interest rates across different protocols and chains, helping users find lower borrowing rates or higher deposit yields.

- During the lending process, users' assets and collateral capabilities are no longer confined to a single chain and protocol, thus improving overall capital efficiency.

- Supports cross-chain arbitrage, leverage, and other strategies without cumbersome asset movements.

Throughout the process, users only need to operate through the Soul interface, while the underlying asset and data synchronization is achieved by cross-chain communication protocols like LayerZero. To enhance the robustness of the system, Soul has also integrated Wormhole, Axelar, and Chainlink's CCIP as backup channels in case of communication interruptions.

Team Background and Current Progress

Soul Protocol is developed by Soul Labs, and the team founder Ahmed S previously developed Hatom. The project has maintained a low profile over the past year, and is currently live on the testnet, supporting mainstream chains and lending protocols, and is open for testing and feedback.

The operation of Soul Protocol adopts a community participation and testing incentive model. During the testnet phase, users can earn points (Seeds) by using the dApp and completing specified tasks. These points will be redeemable for Soul's native token $SO upon mainnet launch.

Currently, the project has not publicly disclosed external financing information but is advancing testing and product optimization through community participation. Users can help identify issues, provide suggestions, and receive corresponding rewards by participating in testing.

(This article is for reference only and does not constitute investment advice.)

Related Projects

Latest News

ChainCatcher

Dec 27, 2025 12:30:45

ChainCatcher

Dec 27, 2025 12:07:57

ChainCatcher

Dec 27, 2025 11:53:59

ChainCatcher

Dec 27, 2025 11:44:45

ChainCatcher

Dec 27, 2025 11:35:45