Bernstein sets $230 price target on Circle stock, calls it the ‘internet dollar network for the next decade’

The Block

Jun 30, 2025 19:15:59

Analysts at the research and brokerage firm Bernstein have initiated coverage on Circle with an outperform rating, setting a price target of $230.

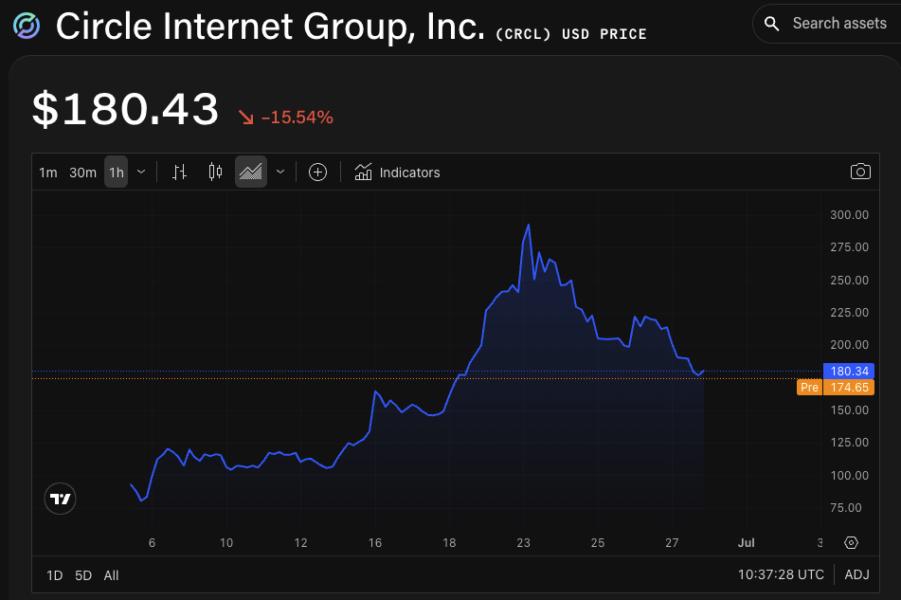

Circle, the issuer of the USDC stablecoin, went public on June 5 under the ticker CRCL in one of the hottest IPOs in years. The offering was 25 times oversubscribed, priced above the indicated range at $31, and soared 167% on the first day. It subsequently surged to a peak of over $292 on June 23 before correcting. CRCL closed down 15.5% at $180.43 on Friday, according to The Block's Circle price page.

"Circle is building a market-leading digital dollar stablecoin network, with a strong regulatory edge, liquidity headstart and marquee distribution partnerships," analysts led by Gautam Chhugani said in a Monday note to clients. "We view CRCL as an investor must-hold, to participate in the new internet-scale financial system built for the next decade."

The analysts expect stablecoins to evolve from the money rail of crypto markets to the money rail of the internet, with the total stablecoin supply growing 16 times to $4 trillion over the next decade, from around $244 billion today. This would be driven by "transformative growth" in crypto and tokenized capital markets, payments, and stablecoin-native financial services, they said.

Circle's USDC is set to become the largest regulated stablecoin under the GENIUS Act, recently passed by the U.S.Senate, giving it a "regulatory headstart" and positioning it as the preferred partner for internet platforms beyond just crypto exchanges, Chhugani argued. Its $61.4 billion in liquidity is difficult to replicate without the crypto distribution flywheel, and many new entrants have struggled with the "cold-start" problem, he said.

However, the Bernstein analysts predict Circle will capture around a 30% share of this potential $4 trillion market — just 5% higher than its 25% share today. Tether's USDT remains the dominant stablecoin, with a current supply of $158.5 billion, representing a 65% market share. As a foreign issuer, Tether may create a new U.S. subsidiary to manage compliance with any new stablecoin legislation in the United States.

Circle's stock is currently trading at 56x 2026 and 28x 2027 adjusted EBITDA — reflecting strong investor appetite for pure-play stablecoin exposure, Chhugani wrote. Bernstein values CRCL at $230 using a 10-year discounted cash flow model, implying around 35x 2027 adjusted EBITDA. The firm projects 47% compound annual revenue growth and 71% EBITDA growth from 2024 to 2027, with USDC adoption expected to offset rate-driven revenue pressure — creating potential buying opportunities during market pullbacks, the analysts said.

CRCL/USD price chart. Image: The Block/TradingView.

Last week, Bernstein analysts raised their price target on Circle's USDC partner, Coinbase, to $510 as the company's shares approached a new all-time high.

Gautam Chhugani maintains long positions in various cryptocurrencies. Bernstein and its affiliates may receive compensation for investment banking services from Circle. Affiliates of Bernstein managed or co-managed the public offering of Circle's securities.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Latest News

The Block

Jul 28, 2025 07:18:58

NewsBTC

Jul 28, 2025 07:00:32

CoinMarketCal

Jul 28, 2025 06:00:27

CoinMarketCal

Jul 28, 2025 06:00:26

CoinMarketCal

Jul 28, 2025 06:00:26